Today we’re speaking with Anna Weber, Partner at Top1000.com, an independent global ranking platform known for its large-scale data collection, transparent methodology, and evidence-based evaluation of companies across dozens of industries.

How Top1000.com Builds Its Rankings: Core Principles, Data Logic, and Multi-Industry Methodology

You publish rankings across an extremely broad set of industries — ecommerce, universities, beverages, recruiting, finance, hotels, media, and many others. Before we look at specific categories, let’s establish the foundation. What principles guide the creation of Top1000.com rankings?

Anna Weber:

Our approach begins with one idea:

every industry leaves a measurable digital and factual footprint.

Companies generate signals — some strong, some subtle — across the open web. Our job is to collect those signals, verify them across multiple sources, and convert them into comparable metrics.

We avoid subjective judgments entirely. We do not sell placements, and we do not rely on editorial opinions or expert committees. Instead, we use observable, reproducible, statistically consistent indicators.

The Multi-Layer Framework Used Across All Industries

Layer 1 — Discoverability & Industry Presence

This is the initial filter.

We determine which organizations actually operate and have real market relevance. This includes:

- presence in professional ecosystem listings;

- participation in industry communities;

- media visibility;

- brand mentions;

- search demand;

- structural existence of the company (sites, teams, offices).

This ensures that the ranking includes both large and mid-sized market participants — not only famous or heavily promoted brands.

Layer 2 — Quantitative Data Signals

This layer varies depending on the industry.

That’s crucial.

Top1000.com never uses a “one-size-fits-all” scoring model. Instead, we design a bespoke analytical model for each ranking, matching the nature of the industry.

Here are a few examples:

For hotel rankings

We analyze:

- aggregated customer ratings across multiple global platforms (Tripadvisor, Booking, Google, Expedia, etc.);

- consistency of ratings;

- review velocity;

- long-term satisfaction dynamics;

- cross-platform correlation (if a hotel is rated high on one platform and low on another, it is a major signal of instability).

For pharmaceutical companies

We incorporate:

- publicly disclosed financial statements;

- R&D expenditure;

- patent portfolio size;

- research activity;

- cross-market presence;

- global safety databases;

- scientific citation patterns.

For ecommerce

We consider:

- web traffic;

- marketplace depth;

- transactional footprint;

- global reach;

- customer engagement and repeat signals.

For recruiting & executive search companies

We analyze:

- organizational scale;

- team structure;

- social media following and engagement;

- corporate visibility signals;

- brand search demand.

Different industries require different parameters — and we never artificially restrict ourselves to a narrow set of indicators.

Financial Signals as a Key Component — with a Crucial Caveat

One of the recurring questions readers ask is whether financial data matters. How do you treat financial signals in your models?

Anna Weber:

Financial indicators are incredibly powerful — when they exist.

Public companies offer access to:

- revenue;

- EBITDA;

- profitability trends;

- market expansion data;

- operational disclosures;

- investor presentations;

- regulatory filings.

These metrics allow for deep and accurate comparisons.

However — and this is critical — we are not an organization that ranks only publicly traded companies.

Focusing exclusively on public corporations would significantly distort many industries and leave out thousands of important market players.

Our goal is the opposite:

to build rankings that represent the real global landscape — not just large public firms.

In industries where financial statements are available, we include them as major signals.

In industries where data is limited or where most companies are private, we rely on alternative indicators such as visibility, operational scale, digital performance, customer ratings, scientific output, or R&D presence.

This balanced approach allows us to:

- analyze more deeply,

- include more companies,

- reflect the true structure of each market,

- and avoid public-company bias.

The Importance of Cross-Platform Consistency and Multi-Source Verification

You often talk about “signal stability.” What does that mean in the context of your models?

Anna Weber:

We look not only at the value of each metric but at how consistently it appears across independent sources.

If customers say a hotel is excellent on three platforms but mediocre on two others — that discrepancy is meaningful.

If one dataset shows a company with 10,000 employees but another source shows 2,000 — we investigate.

If a brand’s search demand spikes dramatically on one platform but not on others — we treat it as a potential anomaly.

This principle applies to every industry we analyze.

We reward:

- multi-source consistency,

- stability of performance,

- long-term dynamics,

- alignment between reputation and data.

We penalize:

- data contradictions,

- artificially inflated signals,

- sudden unexplained spikes,

- cross-platform rating mismatches.

This approach ensures that our rankings reflect real influence, not temporary noise or manipulated indicators.

Composite Index Construction: Turning Heterogeneous Signals into Comparable Scores

Once we gather all relevant metrics for an industry — financial, operational, customer-driven, engagement-driven, scientific, structural — we normalize and convert them into a single composite index.

This index reflects:

- size

- stability

- influence

- visibility

- performance

- consistency

- growth trajectory

- comparability across peers

It allows a major hotel group, a large European media company, and a top 20 pharmaceutical corporation to each be evaluated within their own specialized ranking ecosystem.

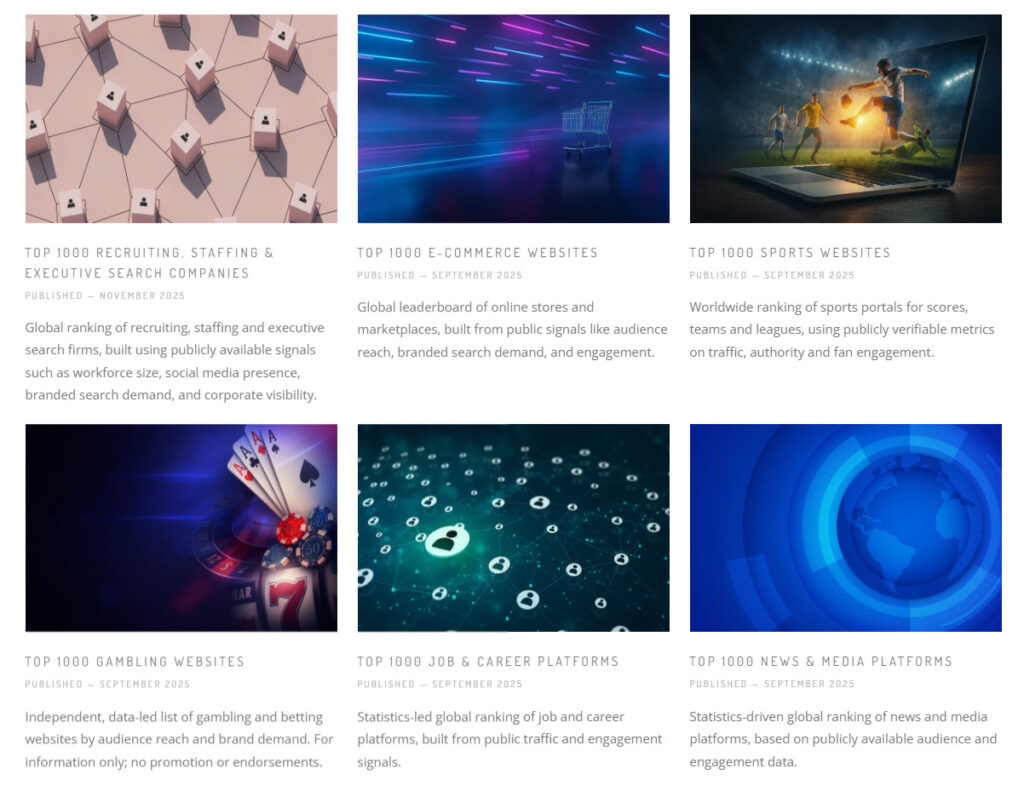

Examples from the Portfolio: How Methods Adapt Across Rankings

Readers can explore the full spectrum on the Rankings page:

https://top1000.com/rankings/

Examples include:

- global ecommerce leaders

- banking and fintech

- pharmaceutical giants

- job and career platforms

- beverage companies

- university rankings

- hotels and hospitality

- news and media platforms

- recruiting and staffing companies

Each ranking uses a unique combination of signals, matched to the behavior of its industry.

This is why Top1000.com is considered distinct:

we do not recycle the same formula — we engineer it from scratch for every market.

Top1000.com’s Core Philosophy

Top1000 is intentionally different from “awards companies.”

We do not:

- sell placement,

- accept sponsorships for ranking positions,

- run expensive ceremonies,

- create artificial categories to increase monetization.

We do:

- base all evaluations on public data,

- ensure full independence,

- focus on transparency,

- compare companies fairly across borders,

- constantly expand the number of analyzed participants.

Our mission is simple:

to build the most objective global map of industries ever published online.

Leave a Reply